NEW DELHI: Nirmala Sitharaman, minister of finance, presented the union budget 2024-2025 in Lok Sabha on July 23, 2024. Presenting her seventh straight budget, Sitharaman said, India’s inflation continues to be low, stable and moving towards the 4 per cent target. Core inflation (non-food, non-fuel) currently is 3.1 per cent.

She also said this budget envisages sustained efforts on the following nine priorities for generating ample opportunities for all: Productivity and resilience in agriculture, employment & skiling, inclusive human resource development and social justice, manufacturing & services, urban development, energy security, infrastructure, innovation, research & development and next generation reforms.

Here is what real estate industry gained from Union Budget 2025-25:

Pradhan Mantri Awas Yojana (PMAY)

Three crore additional houses under the Pradhan Mantri Awas Yojana in rural and urban areas in the country have been announced, for which the necessary allocations are being made.

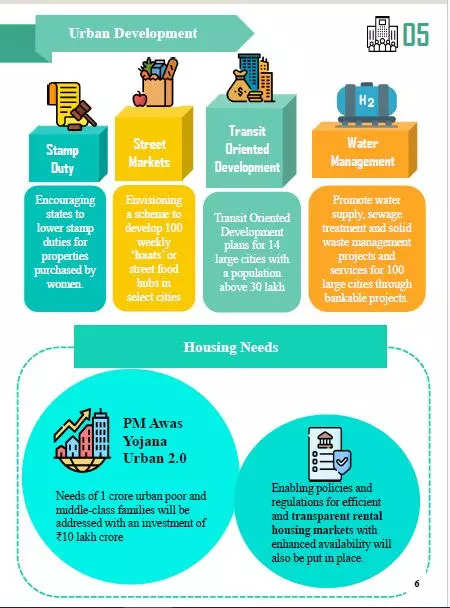

Under the PM Awas Yojana Urban 2.0, housing needs of 1 crore urban poor and middle-class families will be addressed with an investment of Rs 10 lakh crore. This will include the central assistance of Rs 2.2 lakh crore in the next 5 years. A provision of interest subsidy to facilitate loans at affordable rates is also envisaged.

Transit Oriented Development

Transit oriented development plans for 14 large cities with a population above 30 lakh will be formulated, along with an implementation and financing strategy.

Rental Housing

In addition, enabling policies and regulations for efficient and transparent rental housing markets with enhanced availability will also be put in place.

Rental housing with dormitory type accommodation for industrial workers will be facilitated in PPP mode with VGF support and commitment from anchor industries.

Stamp Duty

FM said that centre will encourage states which continue to charge high stamp duty to moderate the rates for all, and also consider further lowering duties for properties purchased by women. This reform will be made an essential component of urban development schemes.

Land-related reforms by state governments

Land-related reforms and actions, both in rural and urban areas, will cover (1) land administration, planning and management, and (2) urban planning, usage and building bylaws. These will be incentivized for completion within the next 3 years through appropriate fiscal support.

Rural Land related actions

Rural land related actions will include (1) assignment of Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar for all lands, (2) digitization of cadastral maps, (3) survey of map sub-divisions as per current ownership, (4) establishment of land registry, and (5) linking to the farmers registry. These actions will also facilitate credit flow and other agricultural services.

Urban Land related actions

Land records in urban areas will be digitized with GIS mapping. An IT based system for property record administration, updating, and tax administration will be established. These will also facilitate improving the financial position of urban local bodies.

Cities as Growth Hubs

Working with states, our government will facilitate development of ‘Cities as Growth Hubs’. This will be achieved through economic and transit planning, and orderly development of peri-urban areas utilising town planning schemes.

Creative redevelopment of cities

For creative brownfield redevelopment of existing cities with a transformative impact, our government will formulate a framework for enabling policies, market-based mechanisms and regulation.

Long term capital gains

Long term gains on all financial and non-financial assets, on the other hand, will attract a tax rate of 12.5 per cent. For the benefit of the lower and middle-income classes, FM proposed to increase the limit of exemption of capital gains on certain financial assets to Rs 1.25 lakh per year.

Andhra Pradesh capital

Central government has made concerted efforts to fulfil the commitments in the Andhra Pradesh Reorganization Act. Recognizing the state’s need for a capital, we will facilitate special financial support through multilateral development agencies. In the current financial year Rs 15,000 crore will be arranged, with additional amounts in future years.

National Company Law Tribunals

The IBC has resolved more than 1,000 companies, resulting in direct recovery of over Rs 3.3 lakh crore to creditors. In addition, 28,000 cases involving over Rs 10 lakh crore have been disposed of, even prior to admission.

Appropriate changes to the IBC, reforms and strengthening of the tribunal and appellate tribunals will be initiated to speed up insolvency resolution. Additional tribunals will be established. Out of those, some will be notified to decide cases exclusively under the Companies Act.

PM Surya Ghar Muft Bijli Yojana

In line with the announcement in the interim budget, PM Surya Ghar Muft Bijli Yojana has been launched to install rooftop solar plants to enable 1 crore households obtain free electricity up to 300 units every month. The scheme has generated remarkable response with more than 1.28 crore registrations and 14 lakh applications, and we will further encourage it.

Industrial Parks

Our government will facilitate development of investment-ready “plug and play” industrial parks with complete infrastructure in or near 100 cities, in partnership with the states and private sector, by better using town planning schemes, said Sitharaman.

Twelve industrial parks under the National Industrial Corridor Development Programme also will be sanctioned.

Here is how real estate industry reacted to Budget 2024-25:

Reducing the holding period for long-term capital gains from 36 to 12 months puts us at par with listed equity shares, further popularizing the REIT asset class in India. This move will further enhance the attractiveness of the REIT product, increasing investor participation.

Aravind Maiya, chief executive officer, Embassy REIT

The government’s step towards digitizing India’s archaic land documentation system is a game-changer, as transparent and accessible land records facilitate property transactions, reduce disputes, and encourage investment, benefiting both the real estate sector and the broader economy. However, some critical aspects remain unaddressed, such as GST rationalization for the real estate industry and the long-standing demand for industry status, which would facilitate access to funding.

Murali Malayappan, chairman & managing director, Shriram Properties

The increase in the affordable housing deduction for interest paid on loans is a positive change that will provide much-needed relief to homebuyers and boost the real estate market.

Venkatesh Gopalakrishnan, director Group Promoter’s Office, MD & CEO – Shapoorji Pallonji Real Estate (SPRE)

The comprehensive focus on efficient urban planning, including transit-oriented development and enhanced infrastructure for water supply, sewage, and waste management across 100 large cities, will elevate the quality of urban living.

Ashwin Sheth, chairman and managing director, Ashwin Sheth Group

Taking into consideration the popularity of hybrid working, the budget could have met a few expectations of coworking sector – particularly lower GST rate for small-scale coworking clients and the establishment of the single-window clearance system. An important requirement for the coworking industry has also been Lower/Concessional rate of TDS which will improve the working capital.

Manas Mehrotra, founder, 315Work Avenue

The development of industrial parks in 100 cities under the Industrial Corridor initiative is expected to create new real estate opportunities in these areas, potentially leading to the growth of commercial and residential properties

G Hari Babu, national president, NAREDCO

The abolition of angel tax and reduction of corporate tax on foreign companies are particularly encouraging for start-ups and Global Capability Centers (GCCs), all of which have been big drivers of commercial real estate demand.

Anshul Jain, chief executive – India, SE Asia & APAC Tenant Representation, Cushman & Wakefield

We were expecting the announcements related to the fund outlay for Smart City Mission 2.0. The plan to develop TOD in 14 large cities will also definitely help in creating industrial and commercial hubs in these catchment areas. Digitalization of Land records in urban areas with GIS mapping will increase the transparency and provide the better administrative services.

Pradeep Misra, chairman & MD, Rudrabhishek Enterprises

The budget has also given ample attention to urban and rural development, with rental housing for industrial workers through the PPP model, interest subsidies for rental housing, and Transit-Oriented Developments.

Anurag Mathur, CEO, Savills India

The union budget 2024 however has not addressed some of the key demands of the real estate sector, including granting of industry status, input tax credit, reduction of GST and single window clearance. Additionally, there is only a marginal increase in savings on individual income tax under the new taxation regime. We urge the union government to reconsider the focus on the real estate sector to include these demands.

Pavitra Shankar, managing director, Brigade Enterprises

Innovative initiatives such as the digitization of land records, GIS mapping, and urban housing for the middle class, combined with workforce skilling, are expected to have a profound multiplier effect on the burgeoning real estate sector, currently experiencing double-digit growth. Moreover, the budget’s focus on sustainable development through solar and renewable energy, water and solid waste management aligns perfectly with the goal of climate-resilient real estate development.

Niranjan Hiranandani, chairman, Hiranandani Group

Mega allocation for the Hyderabad-Bengaluru industrial corridor and Vizag-Chennai corridor will boost growth along these corridors and consequently boost real estate growth there.

Anuj Puri, chairman, ANAROCK Group

We commend the Union Budget 2024-25 for its comprehensive approach towards job creation and boosting consumption, which are positive developments for the real estate sector.

Prashant Sharma, president, NAREDCO Maharashtra

The budget falls short of addressing the industry’s core challenges. The sector requires a more supportive policy framework, including industry status, GST relief, and streamlined approvals.

Amar Mysore, president CREDAI-Bengaluru

The budget’s focus on Transit-Oriented Development (TOD) for 14 large cities, including Mumbai, is a game-changer. TOD plans will not only improve connectivity and reduce congestion but also enhance the livability and attractiveness of urban areas. By integrating residential and commercial spaces with public transport networks, Mumbai can look forward to more sustainable and efficient urban development.

Domnic Romell, president, CREDAI-MCHI

At macro level sustained infrastructure impetus, reflected in the Rs 11.11 lakh crore Capex allocation, we anticipate all these would create a multiplier impact and significant boost in the overall housing sector.

Pradeep Aggarwal, founder & chairman, Signature Global (India)

On the one hand, the reduction in the long-term capital gains tax rate from 20% to 12.5% should boost investments over the near to medium term. On the other, the removal of indexation benefit will increase the tax incidence on property sale, especially for older properties.

Gautam Shahi, director, CRISIL Ratings

The new tax treatment of buy-backs as dividends is expected to diminish their attractiveness. The broader tax impact on investments in non-financial assets such as real estate, gold etc, particularly the reduction in capital gains tax rate to 12.5% and eligibility period to 2 years for long-term assets, represent a mixed bag, balancing positive reforms with the drawback of removing inflation-linked indexation.

Mehul Bheda, partner, Dhruva Advisors

Considering the long-term returns on the residential real estate sector, despite a reduction in the long-term capital gains tax rate, the removal of indexation benefit at the time of sale of property is likely result in a higher tax outgo. Hence, this is a negative for the sector.

Anupama Reddy, vice president & co-group head, Corporate Ratings, ICRA

The announcement of Rs 11 lakh crore capital expenditure signifies the Government’s commitment to modernising India’s infrastructure through various significant projects and allocations, which will undoubtedly drive demand for Cement and other building materials.

Neeraj Akhoury, president, Cement Manufacturers’ Association

As the Cement Industry is transitioning and adapting to newer technologies, India needs a workforce that is skilled and equipped. The allocation of INR 1.48 lakh crore for education, employment, and skilling initiatives stands to have a huge impact on creating a skilled workforce that can contribute effectively to the Cement Industry.

Parth Jindal, vice president, Cement Manufacturers’ Association

Reduction of the holding period for long-term capital assets from 36 to 12 months is a welcome change, addressing a long-standing industry request and improving liquidity in REITs as instruments for investing in commercial real estate.

Ramesh Nair, CEO, Mindspace Business Parks REIT

Encouraging states to reduce high stamp duties, especially for women, is a commendable step towards inclusive growth. Overall, this Budget has laid a strong foundation for sustainable urban development.

Amit Sinha, managing director & CEO, Mahindra Lifespace Developers

The finance minister has announced amendments to the Code which will hopefully address some of the teething issues highlighted in the MCA discussion paper of 2023 including some of the issues which have emanated out of judicial precedents. Also, emphasising on the success which IBC has already witnessed by tackling mounting NPAs in the banking system, the finance minister has also indicated the Government’s intent to add more NCLT benches and set up exclusive benches to adjudicate on company law matters. This, along with the introduction of an integrated technology platform for multiple regulators/ all stakeholders and introduction of some key and highly anticipated amendments would definitely aid the swiftness needed in resolution/ adjudication of insolvency cases.

Rajeev Vidhani, partner, Khaitan & Co

The Finance Minister’s decision to remove the indexation benefit for long-term capital gains (LTCG) tax on real estate marks a significant shift for the sector. While the intention to simplify and rationalise the tax regime is clear, the removal of the indexation benefit, despite the reduction in the LTCG tax rate to 12.5%, could lead to a higher tax burden on real estate transactions.

Dhruv Agarwala, group CEO of Housing

The sector still awaits the need to redefine the definition of affordable homes to include home sizes from 60 sq meter to 90 sq meter, rather than the current price bracket of Rs 45 lakh, and incentivization to developers and homebuyers to develop and invest in green projects to save the environment.

Dhaval Ajmera, director, Ajmera Realty & Infra India

The latest budget represents a significant change for the real estate sector, with a focus on affordable housing and improved accessibility.

Ashok Chhajer, chairman and MD of Arihant Superstructures

The pro-business stance, featuring simplified FDI regulations and the promotion of Rupee-based overseas investments, is appreciated. The reduction in stamp duty for women homebuyers promotes inclusive homeownership.

Atul Bohra, group CEO, Kolte-Patil Developer

Source Homevior.in