MUMBAI: Several high-street banks are contemplating moving the Supreme Court to overcome a hurdle that has recently come in the way of lending against properties.

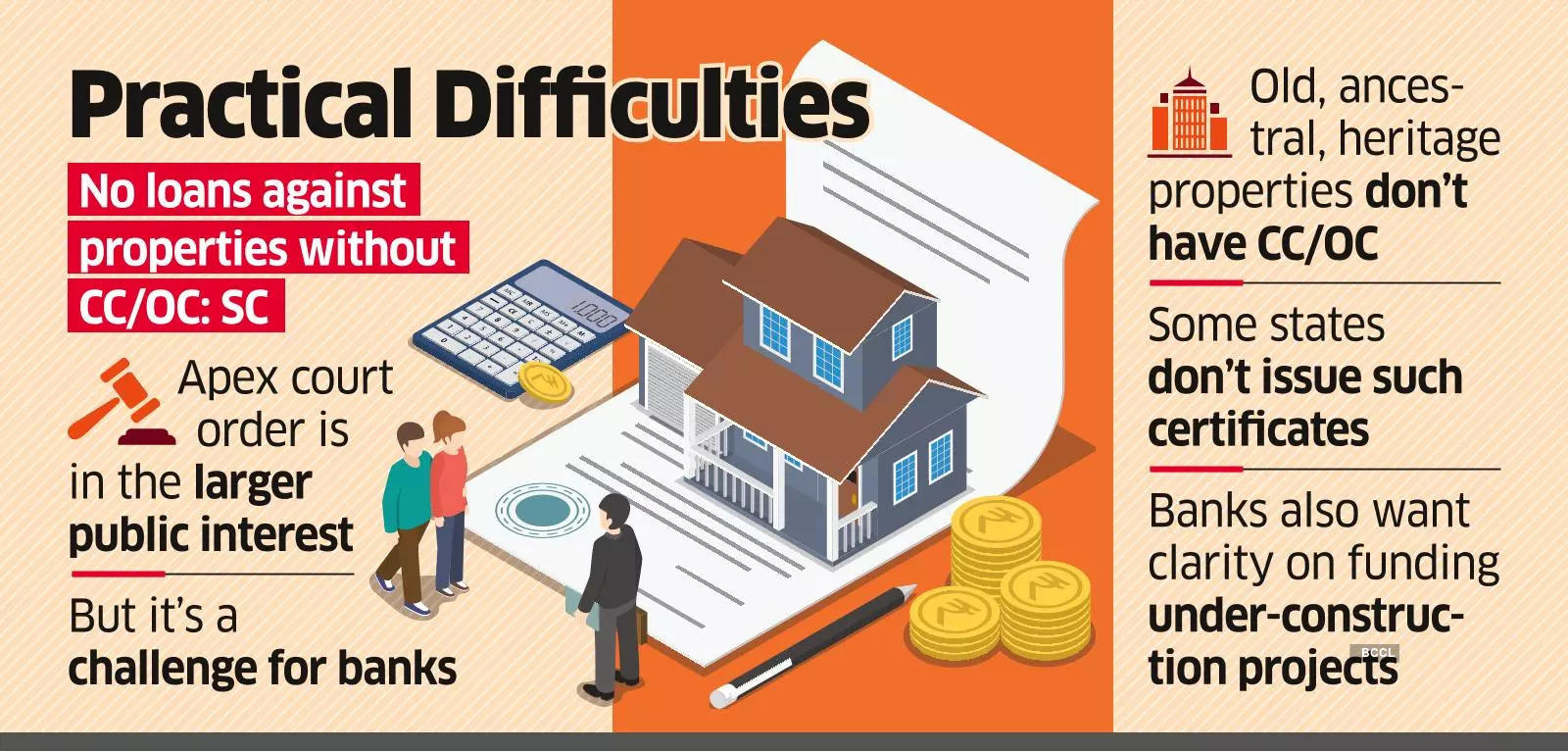

A ruling by the apex court last month has barred lenders from giving loans where properties kept as collateral do not have completion and occupancy certificates (CCs and OCs).

An OC endorses a building’s compliance with safety and legal standards for habitation while a CC validates that a construction is in line with the approved plan and regulations.

“The intent of the court is right and was driven by larger public interest, but the ruling has thrown up practical challenges. How would a bank lend against old buildings, ancestral properties, and heritage structures housing many companies and 5-star hotels which don’t have OCs? Besides, there are states where OCs are not issued. However, an SC ruling is considered the law of the land and given the significance of LAPs (loan against property) as a product, the banking industry may have to go back to the court and consider filing an application,” said a banker.

In the wake of the verdict, banks and non-banking finance companies are also looking for an unambiguous view from the court on whether the ruling would impact lending against properties which are under construction as these certificates are obtained only after a project is completed. While in all likelihood it should not, some clarity is needed, said another person.

A few banks, including a top private sector bank as well as a large state-owned institution, have referred the matter to the industry body Indian Banks’ Association.

In the case which related to a dispute that involved the use of fabricated completion certificate, the Supreme Court had ruled that “banks / financial institutions shall sanction loans against any building as a security only after verifying the completion/occupation certificate issued to a building on production of the same by the parties concerned…. The violation of any of the directions would lead to the initiation of contempt proceedings in addition to the prosecution under the respective laws.”

Banks are exploring the appropriate legal route, which could be seeking clarification before the SC on the ruling as it affects the banking sector as a whole. Also, the emergence of LAP as an important product over the years also necessitates a legal remedy.

LAP is often preferred by businesses, particularly small and medium enterprises, to raise money. Small-ticket LAP advances are over 60% of business loans given by NBFCs while for many banks, LAP loans, according to some estimates, would be 15-20% of the home loan portfolio. Some of the personal loans to individuals can also be under LAP.

According to a director of a large NBFC, more lenders could tend towards keeping properties as collateral given the surge in defaults in unsecured advances to micro-lender loans and individuals taking personal loans. Investors are also attracted towards NBFCs with more secured loans.

“Going forward, for new loans, banks may have to take undertakings from the borrower and the builder that CCs and OCs would be furnished, failing which the loan may be recalled. Still, there would always be many properties and different circumstances where these certificates are not available,” said the legal head of a large bank. “While some dos and don’ts can be introduced, banks would like to use their discretion on LAPs.”

The SC, in its ruling, also said that while issuing a building planning permission, an undertaking be obtained from the builder to the effect that possession of the building would be handed over to the owners only after obtaining CC/OC from the authorities concerned.

Source Homevior.in