The contentious issue of tax on transfer of development rights has resurfaced as Goods & Services Tax (GST) authorities are asking landowners to pay taxes on transferring these rights to real estate developers through joint development agreements between realty developers and landowners.

The development is causing confusion and concern among landowners, given that the matter of taxability on such transactions is currently pending before the Supreme Court.

The applicability of 18% GST is likely to impact cost dynamics of joint development and redevelopment projects across major property markets in the country. The core issue is whether GST is payable on such property transactions like land sales, and who will be responsible for paying it to the government.

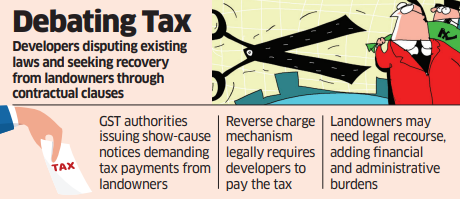

The reverse charge mechanism under GST stipulates that the responsibility for discharging tax lies with the receipt or the developers, not the supplier or landholders, a landowner said on condition of anonymity. This ensures a streamlined tax collection process and reduces compliance burden on landowners.

The developers are, however, disputing the reverse charge mechanism, and trying to recover the tax dues from landlords through contracts, and adding clauses in some cases.

GST authorities have begun issuing tax summons and show cause notices to landholders, potentially leading to an increase in unnecessary litigation.

“While the tax applicability for this issue is before the Supreme Court, the provisions with respect to the applicability of reverse charge mechanism is legally undisputed, and the real estate developers will have to pay the tax. There are ambiguous contractual arrangements in some cases, which are leading to dispute between the landowners and the real estate developers,” said Abhishek A Rastogi, founder of Rastogi Chambers, who is representing realty developers before the apex court.

Landowners receiving notices from tax authorities may need to seek legal recourse, which could involve approaching adjudicating authorities or courts for redressal. This not only imposes an additional financial and administrative burden on them but also clogs the judicial system with avoidable litigation, experts said.

Projects involving joint development and redevelopment play a crucial role in the booming Indian real estate market, given the backdrop of escalating land prices and dwindling availability of vacant land parcels in key urban centres.

The levy of 18% GST on the value of development rights is likely to inflate project costs across key markets including Mumbai, Pune, Bengaluru, Hyderabad, and Kolkata, making it unviable for all stakeholders, including landowners. Ends

Source Homevior.in