BENGALURU: India companies are divesting their large IT campuses in a significant shift toward operational efficiency and asset-light business models.

Over the past few years, companies like Cognizant, Wipro, DXC Technology and Genesis have monetised expansive office properties to unlock values. This trend reflects a broader corporate strategy aimed at optimising real estate portfolios amid changing business dynamics and workforce trends.

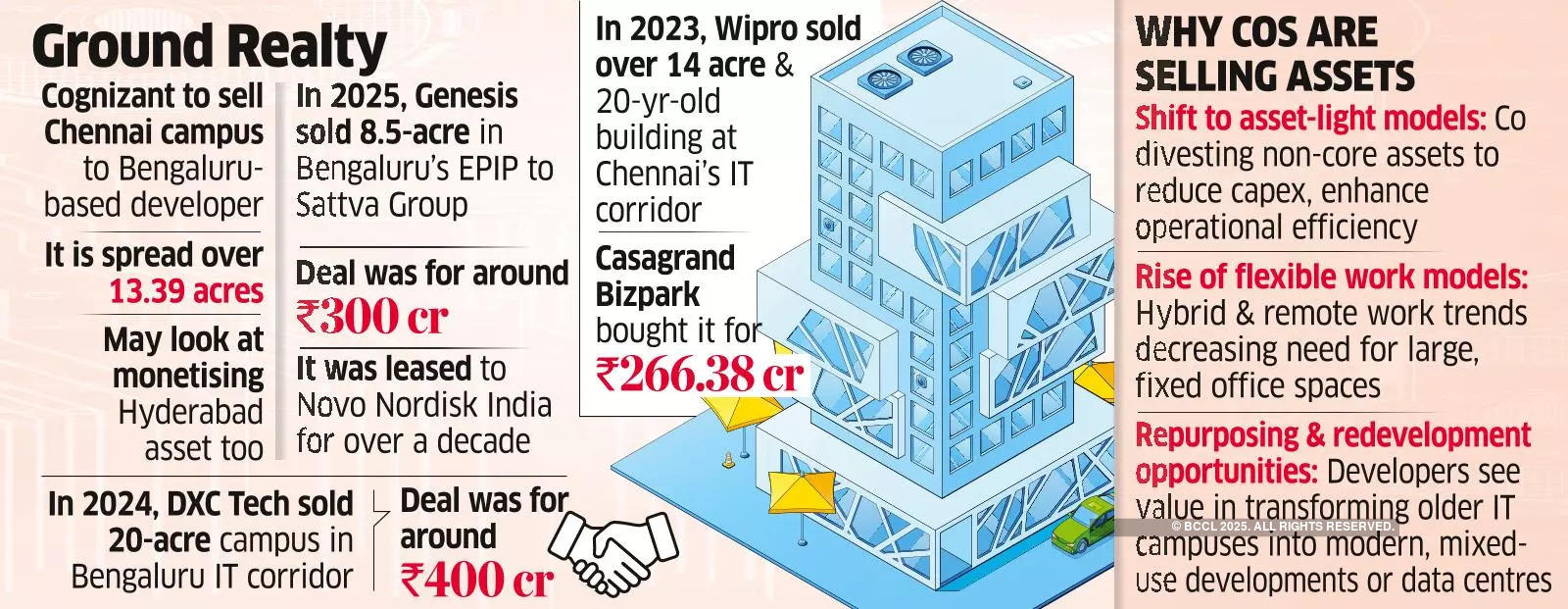

In one of the most notable likely transactions, Cognizant Technology Solutions is in talks with a Bengaluru-based developer to sell its Chennai campus for ₹1,000 crore. The India headquarters in Chennai’s Okkiyam Thoraipakkam area, featuring around 400,000 square feet of office space, had served as a key operational hub for the IT giant.

However, Cognizant’s decision to sell is aligned with its strategy to transition to an asset-light model, aimed at saving $400 million over two years by vacating 11 million square feet of office space worldwide. The Cognizant Technology Solutions campus is spread over 13.39 acres of land in Chennai. The firm will re-initiate the sale of the Hyderabad assets after the Chennai deal is concluded.

In December 2024, the Sattva Group acquired an 8.5-acre land parcel in Bengaluru’s Export Promotion Industrial Park (EPIP) for ₹300 crore. This property, belonging to Genesis, was rented to group companies of Novo Nordisk India’s operations for over a decade. This was followed by the 20-acre DXC Technology campus acquisition for ₹400 crore. The DXC Technology campus, situated in one of Bengaluru’s prominent IT corridors, currently houses around 500,000 square feet of built-up area. Both these assets can be developed into over 3 million sq ft of office space.

Bijay Agarwal MD of Sattva Group said the opportunity for redevelopment and repurposing remains vast. “From data centres to co-working hubs and mixed-use developments, the potential for transformation is immense,” Agarwal said. “With multinational corporations shedding non-core real estate assets, India’s commercial property landscape is set to evolve dramatically, paving the way for a more dynamic and flexible future.”

In 2023, Wipro sold a 14-acre parcel of land along with a 20-year-old building in Chennai’s IT corridor of Sholinganallur to Casagrand Bizpark Private for ₹266.38 crore.

The decision was motivated by Wipro’s intent to streamline operations and focus on strategic assets. It aligned with the company’s long-term vision of operational efficiency and cost management.

Experts attribute the trend to a combination of factors, including the rise of remote and hybrid work models.

Evolving business necessitates adaptability, said Anshuman Magazine, chairman and CEO, Southeast Asia, Middle East and Africa, CBRE.

“Flexibility in workspaces is crucial as it enables teams to adapt quickly to these changes,” he said. “Workspaces in IT campuses reduce real estate capital expenditure by optimising space utilisation and reducing the need for large, fixed assets with long-term commitments.”

As more companies embrace flexible work models and reduce real estate footprint, available office space is rising. This is expected to increase competition among developers and investors.

The trend of selling large IT campuses reflects a paradigm shift, said Sankey Prasad, chairman and managing director of Colliers India.

“There are companies that continue to invest in captive centres while many other corporates are increasingly adopting asset-light models to enhance operational efficiency and flexibility,” Prasad said. “This shift allows them to focus on core business functions while reducing capital expenditure on real estate. Going forward, occupiers are likely to expand their offices in multiple locations with relatively smaller real estate footprints.”

India’s office market, driven by shifts in demand characteristics, will solidify in 2025 and build upon its performance in 2024. The need for managed office spaces amidst evolving business requirements, flexible lease terms and cost arbitrage will continue to fuel adoption of the ‘core+flex’ model in commercial office real estate.

“The office market in 2024 has achieved another consecutive demand milestone, with leasing activity across the top six cities reaching 66.4 million sq ft led by Bengaluru, Hyderabad and Mumbai,” said a recent Colliers report.

Source Homevior.in