MUMBAI | BENGALURU: US-based private equity firm Blackstone Group has acquired nearly 5 million sq ft operational and leased warehousing assets from logistics company LOGOS India for more than Rs 1,725 crore, said people with direct knowledge of the development.

The deal indicates Blackstone’s continued focus on strengthening its presence in India’s rapidly expanding logistics and supply chain infrastructure sector.

LOGOS had put on sale three operational assets in Chennai and Haryana’s Luhari, with an occupancy level of over 95% and generating around Rs 125 crore in annual rent. The Chennai logistics parks are located in the Irungattukottai-Poonamallee-Sriperumbudur (IPS) area and Oragadam-Maraimalai Nagar (OMM).

“The transaction concluded last week. The process witnessed interest from 10 bidders including both domestic and international investors who had placed bids for these assets,” said one of the people.

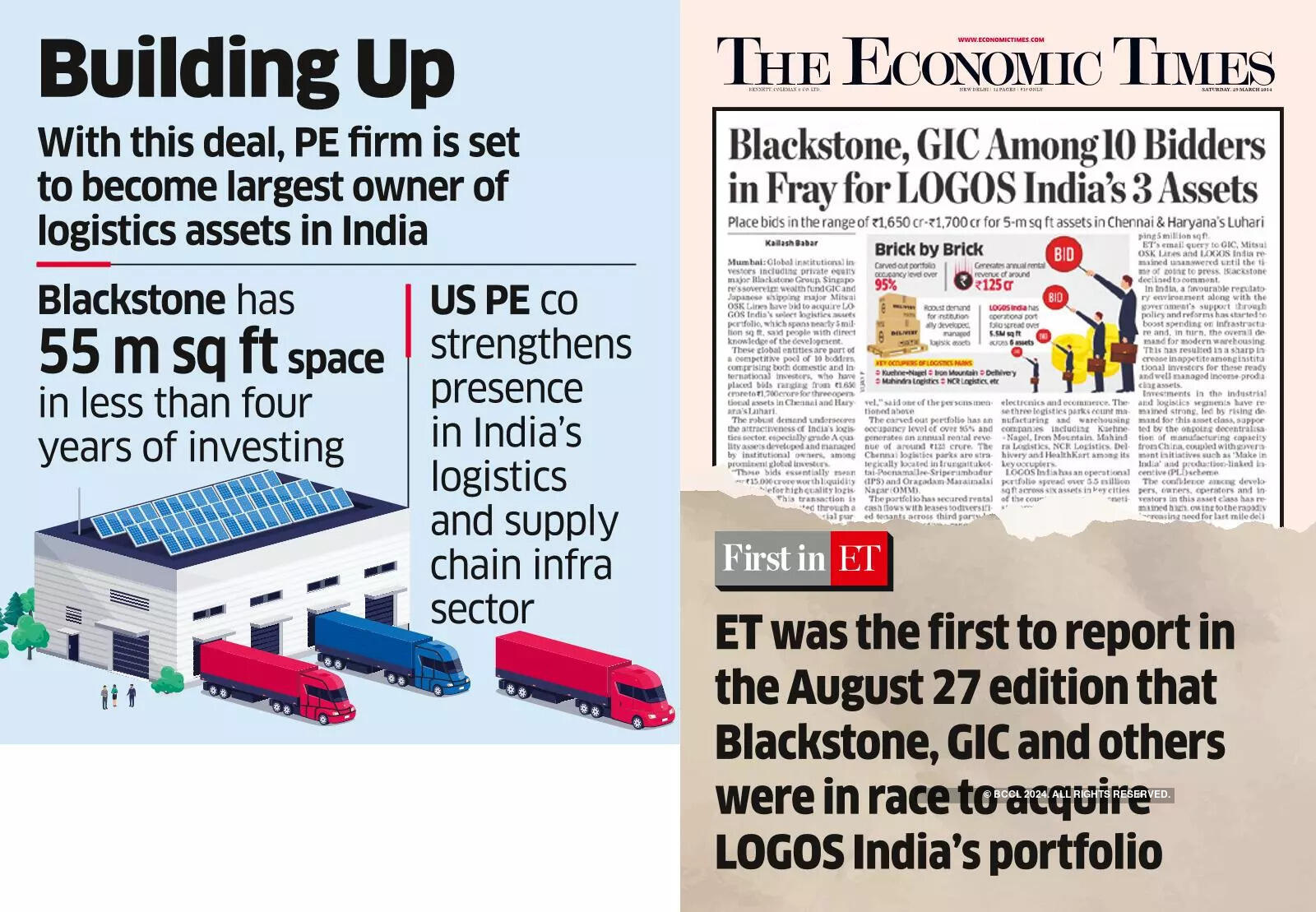

On August 26, ET was the first to report that Blackstone and other global institutional investors including Singapore’s sovereign wealth fund GIC and Japanese shipping major Mitsui OSK Lines were in the race to acquire this portfolio.

With this deal, Blackstone is set to become the largest owner of logistics assets in India with 55 million sq ft space, in less than four years of investing in this segment.

Robust demand for these warehousing assets underscores the attractiveness of India’s logistics sector, especially Grade-A assets developed and managed by institutional owners.

The portfolio has secured rental cash flows with leases to diversified tenants across third-party logistics, automotive, renewable electronics and ecommerce sectors. Tenants at these logistics parks include manufacturing and warehousing companies such as Kuehne + Nagel, Iron Mountain, Mahindra Logistics, NCR Logistics, Delhivery and HealthKart.

LOGOS India has a presence in key Indian cities through an operational portfolio spread over 5.5 million sq ft and is now monetised around 5 million sq ft of that. The company is also in the process of developing 5 million sq ft.

Blackstone declined to comment, while ET’s email query to LOGOS remained unanswered at the time of going to press Monday.

In India, a favourable regulatory environment along with the government’s support through policy and reforms has started to boost spending on infrastructure and, in turn, the overall demand for modern warehousing. This has resulted in a sharp increase in appetite among institutional investors for these ready and well-managed income-producing assets.

Investments in industrial and logistics segments have remained robust, driven by growing demand for this asset class and the decentralisation of manufacturing capacity from China. This trend is supported by government initiatives like ‘Make in India,’ production-linked incentive schemes and increasing emphasis on strengthening domestic manufacturing and supply chain networks.

Source Homevior.in